I. Results

In Q1 2024, the model portfolio returned 11.3%. An amazing start of the year, but outclassed by the the S&P 500 which returned 12.83% (in EUR).

Despite lagging behind the index until the end of February, the portfolio made a significant recovery, rising by 9% in March. The composition of the portfolio at the end of Q1 is as follows:

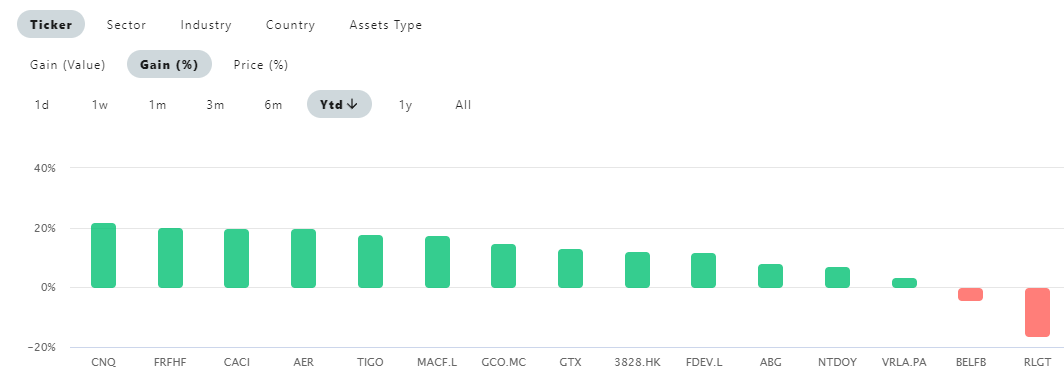

Here are the results per stock:

Results vary greatly, from from +21% for CNQ to -16% for RLGT12.

Nonetheless, somehow most stocks performed well this quarter. The rising tide of “risk on” lifts all boats, even those that aren’t AI beneficiaries.

I don’t want to spend too much time on broad market commentary, or whine about the effects of index investing and how the returns of the market are driven by just a few of the biggest stocks. You can read about that in every other fund letter.

But I do want to note that froth is back in the market, particularly in certain pockets. The cross you bear as a value investor as that you sell before the top, and because of that you’ll often underperform in times of extreme greed. However, I hope to make up for that in other periods: a big contributor to the recent CAGR of my personal account is a return of 7% in 2022, with major indices down that year.

Disclaimer: This content is for educational and entertainment purposes only and is not intended as financial advice. Perform your own research and consult a qualified financial advisor. The author may hold positions in the discussed stocks. This is not a recommendation to buy or sell securities.

II. General Themes & Thoughts

As I already mentioned: I will not bore you with a broad macro analysis and market commentary. However, I do want to talk about a couple of general thoughts and themes I currently keep in mind.

I don’t go all in on a theme, and not every stock I own needs to fit a theme. But these themes serve as interesting areas to explore for investment opportunities, or they can explain why some stocks seem undervalued.

EV Adoption will be slower than planned

The ambitious targets for electric vehicle (EV) adoption always seemed aggressive to me. Recently, signs of a slowdown in EV demand have become increasingly apparent. Just a year ago, people were still egging on Toyota for not being aggressive enough in their EV strategy.

They’ve really squandered the lead that they had in electrification, being an early player in hybrids, having more experience with electric drivetrains and batteries than other automakers. But they never really did much with it when it comes to BEVs, and now they’re behind.

Fast forward 12 months, and you have the Financial Times asking “Was Toyota’s bet on hybrid cars right all along?”.

Now the narrative change has even hit “mainstream finance YouTube”:

Some of the cheapness in auto dealers like Asbury Automotive Group ( ABG 0.00%↑ ) and auto parts manufacturers like Garrett Motion ( GTX 0.00%↑ ) was explained by the rise of EVs. Neutralizing part of the bear thesis should help the returns of these stocks.

Rise of the Pods - Beat the Pods

(Disclaimer: my understanding of the pods phenomenon is simplified and likely a caricature. Nonetheless, I hope this simplified version of reality still provides a useful framework to keep in mind and potentially use to our advantage)

Pod shops, or multimanager hedge funds, are funds that allocate money to numerous internal teams (pods) focused on distinct strategies. These funds typically use significant leverage (5-6x) to magnify returns and employ both long and short positions. FundamentEdge has been tweeting about it, been on podcasts about it, but he’s not the only one. Kuppy has recently written about it.

The main idea is that the pods buy stocks with near term positive EPS or revenue revisions (positive rate of change) while shorting downgrades and decelerating numbers.

This approach with high leverage demands tight risk control: they need to be able to sell down quickly before a position moves against them in a big way. This phenomenon can amplify volatility.

Because of this, pods have a hard time owning a company that looks good over a 2-3 year horizon, but will possibly have a couple of bad quarters coming up. Pods rather not own short-term weaknes since it is hard to stick to those trades when running a highly levered portfolio. If there is a chance a stock goes down 15-25% before it goes up, they either can't own it or I can't own it in size.

There are some names in the portfolio like RLGT 0.00%↑ that are or were in a recession, with EPS going down, undergoing negative earnings revisions. It always feels like the bottom has to be in, but then it gets postponed for yet another quarter. This company is cheap on trough numbers, and very cheap on normalized numbers. But the stock price is still waiting for the bottom to be officially in and earnings to trend up again.

Similar story with BELFB 0.00%↑: they don’t know when earnings will bottom and their guesstimates for the recovery are based on historical patterns instead of seeing actual green shoots in demand.

… historically, when we've gone through periods of softness, I'd say 1 to 3 quarters is probably the norm, maybe 4 quarters worth. When we look at the industry, it started going through this softness roughly around Q4 '22. So if that is true, if Q4 '22 was the date, we are roughly 5 quarters in, right, and now we're heading into the sixth quarter. So probably a little bit extended from a historical perspective.

(CFO during Q4 23 Earnings Call)

Their reduced guidance for Q1 24 really spooked markets:

Both of these companies will be fine long term, but experience near term weakness and it’s unclear when this weakness will end. But it will end.

Now the names I mentioned are probably too small for the pods to be involved in, but the principle remains: in some situations the market just doesn’t want to own short term weakness, even when the long term returns will be good.

Part of the “Beat the Pods” strategy is the return of time arbitrage. A concept that has been so horriby overused the past couple years that I’ve grown to hate it… but I think it’s time for the comeback.

gave an excellent definition, without using the phrase:We bought stock in Danaher, Thermo Fisher Scientific, and Sartorius. This investment follows a pattern that has worked well for us historically – these companies saw a contraction in revenues and profits in 2023 due to well-understood, temporary, cyclical factors. There are no new major worries about their competitive positions, their ability to generate profits, or their ability to grow over time. Many investors in the public markets cannot, for one reason or another, stomach poor short-term business results and the ensuing volatility in stock prices. This aversion to losses led to selling pressure and stock price declines to levels below what I considered to be fair value. I don’t know when exactly their businesses will recover, but when they do I expect that we will make strong returns on these investments.

III. Portfolio Updates

Friendly reminder: I share portfolio updates live on Substack Notes.

Top Contributors and Detractors

During Q1, the position in CNQ 0.00%↑ saw the highest percentage increase, marking it as a standout performer. But AER 0.00%↑ made the biggest contribution to the portfolio's overall performance, thanks to both solid returns and its substantial position size within the portfolio.

The big loser was RLGT 0.00%↑ . This microcap is an asset-lite freight forwarder. The sector is going through a recession, and there will be a rebound. But the timing of this rebound is unclear. It always seems to be story of “next quarter will still be bad, but we could see a rebound in 6 months”. The stock has been trending downward after earnings, with no significant news.

Exited Positions

I fully exited my position in Avation Plc (AVAP) at 119.75p, at a small loss. Avation was one of my first write-ups:

My investment in the company was based on activist involvement, industry tailwinds and a big discount to book value. The expected activist momentum has not materialized, with no extra share purchases or impactful announcements.

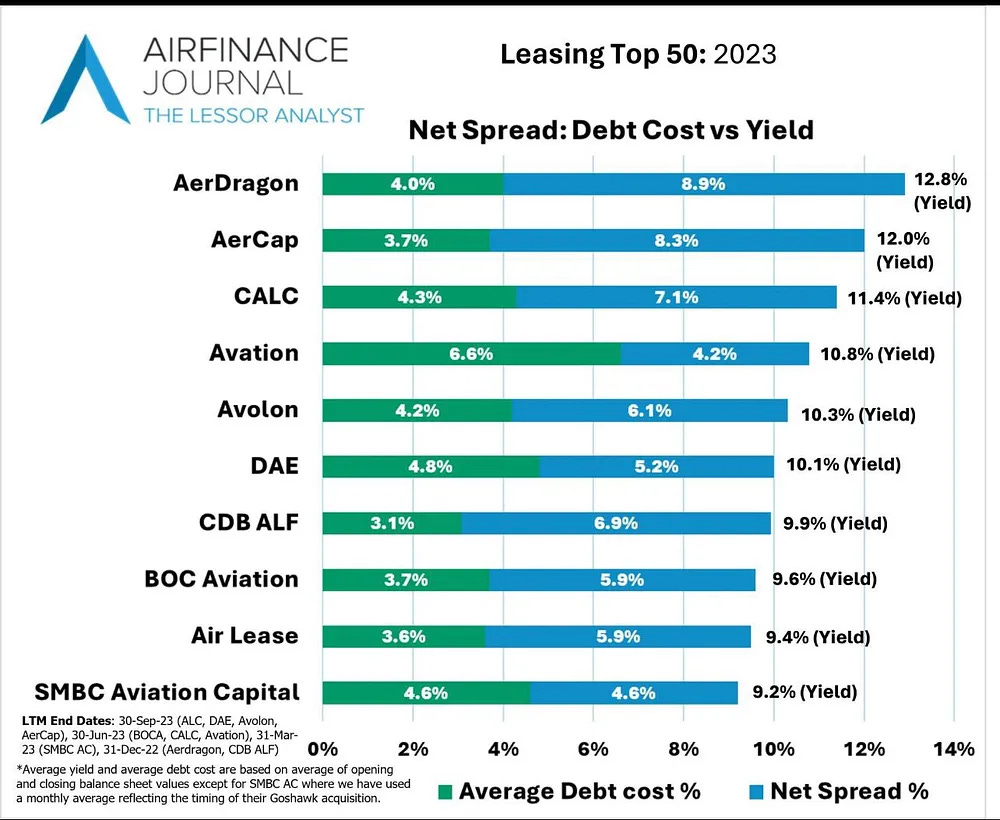

On top of that, the industry basically consists out of “haves” and “have-nots". And AVAP is a have-not. This is actually part of the bull case: a big player has access to cheaper debt and could acquire Avation to squeeze more earnings out of the same assets.

But when the official AVAP twitter account tweeted the following picture highlighting the difference in cost of capital, that seemed to come from a position of weaknes.

AerCap on the other hand enjoys the same industry tailwinds while being in a position of strength.

There’s a better joke to be made here with this meme template, but this is all I got for now:

With a 10% position in AER 0.00%↑, I decided to let go of AVAP and recycle capital in better opportunities.

In addition to that, I sold the full position of LVMH (MC.PA). Occasionally, I’ll buy a temporarily out of favor compounder. I can easily hold and let the underlying businesss compound if the stock doesn’t rerate, but will likely sell if the multiple goes up again. Hopefully these investments provide diversification to the portfolio and can act as a source of cash to rotate into other opportunities. LVMH was one of those.

The company was added to the portfolio at the beginning of the year for €733, with a slight increase in my position at €668. I exited above €845, taking advantage of the valuation re-rate.

The stock occasionally gets hit by China fears. This is a key market for their growth, but the luxury sector can get dragged into trade wars and tariffs posturing. Additionally, LVMH feels the impact when spirits industry peers, like Pernod Ricard, Diageo or Rémy Cointreau, face challenges or when inferior luxury “peers” like Kering or Burburry announce a bad outlook.

But then LVMH releases its own earnings report and demonstrates their superiority in the sector. This is what happened in Q1.

This resilience make it feel like a safe compounder in which you can buy the dip when the forward P/E reaches the 20-22x range.

New Positions

Garrett Motion ( GTX 0.00%↑ ) is a manufacturer of turbochargers. This is an engine part that improves performance and efficiency for cars, as well as commercial and industrial vehicles. Originally a spin-off from from Honeywell, Garrett was saddled with some legacy asbestos liabilities. GTX had to file for bankruptcy and re-emerged in April 2021 with less debt.

At that time, the company had both common (GTX) and preferred shares (GTXAP), with the preferred shares representing most of the company's value. This unusual capital structure made it unownable for a lot of investors.

Since then, Garrett Motion has been generating cash and reducing its debt. In April 2023 they collapsed the share structure by retiring the preferred shares.

The biggest shareholders are funds who were involved in the bankruptcy process. They’re not in it to buy and hold and are slowly selling down their stakes. This puts some downward pressure on the share price, but GTX takes advantage of that by buying back their cheap shares.

At a current share price of $9.80, the market cap is $2.3B. At the midpoint of their 2024 guidance, they will produce 375m of FCF. That’s a 16% FCF yield. During their October 2023 investor day, GTX projected to earn $1.7B-$2.1B of cumulative FCF over the next 5 years. But maybe more importantly: after buying back over $200m of shares in 2023, they announced a new share repurchase program for 2024, to a tune of $350m.

I was interested before, but became especially interested after this big buyback announcement.

Frontier Developments is a UK-listed game developer (FDEV.L). Game developers generally are in a bad place right now. After big tailwinds from COVID lockdowns and influx of capital during the 2021 boom, most of the sector now has to downsize and focus on profitability. FDEV had a share price of 1100p in February 2020, peaked mid 2021 around 3200p and ended Q1 24 at 141p. Talk about a rollercoaster!

FDEV has its roots in a profitable niche: CMS games (Creative Management Simulation) such as Planet Zoo, Planet Coaster and Jurassic World. They spread themselves to thinly and started making games outside of their expertise. This was not a success and the company recently announced to get back to basics: FDEV plans to cut costs and produce 3 CMS games across 2025-2027.

At my purchase price of 125p, the market cap was a bit less than £50m GBP, with net cash. Projected revenue for 2024 is £85m, almost down 20% from the year before. The company expect to lose money this year, but return to sales growth and profitability in 2025.

David Braben, the founder, still owns 32.7%. Tencent owns 8%. When the stock kept dropping in Q1, insiders stepped up and bought shares between 110p and 120p.

A bullish scenario could see 20% EBIT margins at £120m revenue at some point, implying £25m EBIT. Slap a 10x multiple on that and we’re talking about a share price of over 600p.

Clearly the market isn’t very optimistic about the prospects of that happening. Cost cuts and firing people always works better on a spreadsheet than in real life. But I think that FDEV has a profitable core, with its own IP, and a back catalogue of games that still provides a lot of revenue (55% of sales in H1 24 came from the back catalogue). Management sounds very confident in their chances:

Pivot to CMS is not just because we know how to make them. We know how to sell them, we know our audience.

Get ourselves back into profitability. It's not just about cost cutting. It's fundamentally trying to improve the business.

We know CMS games. Know how to launch them, price them, sell them.

A company update last week alleviated some of the cash raise concerns the market seemed to have. This seemed like a big deal and the stock is up 38% in the last 5 days (184p at the time of writing)!

Because of the option-like nature of this investment, I went for a smaller than usual position when making the purchase.

(This Twitter thread is what got me to look at FDEV)

Other Notable Portfolio Events

Canadian Natural Resources CNQ 0.00%↑ has successfully reached its debt reduction target ahead of schedule and is now allocating 100% of its FCF to shareholders via dividends and buybacks.

In 2023, this FCF was $7.94B. At the current share price of $81.18, CNQ has a market cap of $87B , which would make that a 9.1% shareholder yield (= dividend yield + buyback yield). This is after cash spent to maintain and even grow production.

Bel Fuse ( BELFB 0.00%↑ ) had aworse than expected outlook for Q1 24 and crashed big time. I bought the dip and wrote about it.

Millicom ( TIGO 0.00%↑ ) had good results, and a bullish outlook. I increased my position after their earnings report.

Fairfax (FRFHF) was the target of Muddy Waters (MW) short seller report. MW claimed that book value was overstated by 20%, but had no comments on the actual earnings power of the business. The company responded professionally to the report and addressed it like you would want them to. The share price recovered quickly. MW got a chance to ask some questions on the earnings call a week later, and that marked the end of the short seller saga.

Seems like MW was kind of throwing spaghetti against the wall to see what sticks, with the implication of “there’s never just one cockroach in the kitchen”. I used to think highly of Muddy, but this episode makes me a bit more sceptical.

IV. Closing Thoughts

I’m happy with the Q1 performance of the portfolio and excited about the prospects of the current holdings.

I’m still trying to figure out where exacty I want to go with this Substack. Gradually I will address all positions in the portfolio, and likely I’ll do the occasional earnings review of some of the holdings.

In the meantime, if you have made it this far: a like, comment or share goes a long way to show your appreciation while also contributing to the growth of No Deep Dives. Thanks!

Note that I trimmed and added to positions in the quarter, so these numbers are not just equal to the quartery performance for the stock. E.g. my Bel Fuse position outperformed the stock YTD, as I bought the dip after Q4 23 earnings.

I’m using Portseido to track this model portfolio. Returns for the full portfolio look correct, but individual stock returns, YTD, in % seem a bit off. Reason seems to be dividends to have been attributed to the stock, but the stock didn’t go ex-dividend yet! I hope this effect disappears after a while, when those dividends have been actually paid out.

I am still long AVAP. Few points:

1) this chart shows that a) they are good takeover candidate and b) they have leverage to falling interest rates.

2) no buyback because they are not making real money currently. However if their cost of capital fall even slightly they will have spare money to buyback shares.

3) Valid point on EC made by CEO: there is very shallow market for company's stock. Avg volume ~100k. At 20% of volume buying 5mln of shares is half a year (I know if they start buyback liquidity might probably increase, but IMO it's interesting point anyway). Selling planes to buyback shares is not valid strategy given they are already sub-scale.

4) No activist involvement - no VISIBLE I would say. Given points 2&3 - what would you expect them to do? They are kinda traped right now with 20% of illiquid company. The only viable exit strategy is through takeover. I think they are working on it (they are very quiet, probably for regulatory reasons. Chris wrote on twitter that they are cooperating with management and can't speak publicly about company). I think they are smart. Are there any other options for them to realize value that I can't see?

Overall I see it as low risk asset play, which is nice addition to portfolio. Patience is the key.

Guess Muddy isn't entirely done with Fairfax yet. They just put put this tiktok/reels-style video: https://twitter.com/muddywatersre/status/1777349072111682017

Interesting approach?